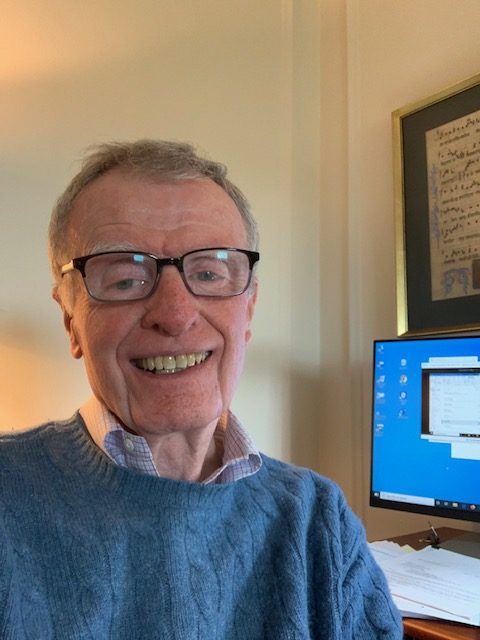

Joseph P. Harrington

Counsel

Joseph P. Harrington concentrates his practice in New York commercial lending law and real estate transactions. Joe chairs our Commercial Finance and Real Estate Transactions groups. Joe represents many institutional lenders in commercial lending, including savings banks and commercial banks and life insurance companies in structuring and closing construction, interim and permanent mortgage loans on office buildings and parks, apartment buildings, hotels, marinas, residential and commercial condominium projects, industrial complexes, shopping centers, golf courses, municipal parking facilities, affordable housing projects, mixed use developments and residential subdivisions. Many of these transactions have involved sophisticated financing techniques, such as sale and leaseback, leasehold, mezzanine and industrial bond financing.

Joe also has extensive experience representing institutional lenders in secured and unsecured commercial lending transactions for corporate and partnership borrowers , including, for example, revolving credit facilities, term loans, credit lines and letters of credit.

During his career, Joe has also represented private companies and individuals in the development, financing, leasing, sale or exchange of raw land, office buildings, apartment buildings and residential subdivisions.

With the assistance of our Commercial Litigation lawyers, Joe also advises clients on problem loans which may require restructure, workout and, if necessary, litigation, including mortgage foreclosures.

Joe has also received a peer review rating of AV®Preeminent on Martindale-Hubbell®.

Areas of Experience

- Representation of Banks and Other Lenders on Various Lending Transactions

- Lending through Sophisticated Financing Techniques, such as Sale and Leaseback, Leasehold, Mezzanine and Industrial Bond Financing

- Secured and Unsecured Corporate Lending, including Revolving Credit Facilities, Term Loans, Credit Lines and Letters of Credit

- Representations of Private Companies and Individuals in the Development, Financing, Leasing, Sale or Exchange of Raw Land, Office Buildings, Apartment Buildings and Residential Subdivisions

Harrington Lectures on Real Estate Financing at Pace Law School

Joseph P. Harrington was part of a panel presentation on a program entitled, “The Fundamentals of Financing Real Estate Transactions” at Pace University School of Law on March 4, 2010 in White Plains, New York.

Harrington Lectures on Commercial Finance for Pace

Joseph P. Harrington was part of a panel presentation on commercial finance and real estate development issues for a two-day program on May 17th and 18th, 2007 in White Plains, New York, sponsored by the Real Estate Law Institute of the Land Use Law Center at Pace University School of Law.

Harrington Lectures on Commercial Lending issues

Joseph P Harrington lectured on April 20, 2005 or Pace University School of Law in White Plains, New York on Commercial Lending issues as part of a program on “Commercial Real Estate Transactions”.

Harrington Lectures on Commercial Lending Issues

Joseph P Harrington lectured on April 21 and 28, 2004 for Pace University School of Law in White Plains, New York on Commercial Lending issues as part of a program on “Commercial Real Estate Transactions”.

Harrington Lectures on Commercial Real Estate Transactions

Joseph P. Harrington lectured on January 17, 2001 on Commercial Real Estate Transactions at Pace University College of Law as part of Pace’s Continuing Legal Education program

Representation of Private Banking Client, as Lender, in a $18.8 Million Multi-State Secured Financing

Joseph P. Harrington, Yvonne St. John

Commercial Finance – Secured Lending – Multi-State Financing

Our commercial finance lawyers sometimes represent banks in transactions involving multiple parcels in multiple states. In one such transaction, Joe Harrington and Michelle Santoro represented one of the firm’s private lending clients on a multi-loan transaction, totaling $18.8 million, secured by four parcels in 3 states.

Commercial Finance – Real Estate Transactions – $21 Million Construction Loan for Development of Mixed Use Shopping Center

Commercial Finance – Real Estate Transactions – Construction Loan for Mixed Use Shopping Center

McCarthy Fingar’s Commercial Finance lawyers often represent our lending clients in commercial Real Estate Transactions. Here, Joseph P. Harrington represented the lender on a $21 million dollar construction loan for the development of a mixed use shopping center with a national supermarket as the anchor tenant under a long term lease.

Representation of Banking Client in Successful Restructure of Corporate Debt

Milton R. Gleit, Joseph P. Harrington

Commercial Finance – Corporate & General Business – Successful Restructure of Corporate Debt

Our Commercial Finance & Corporate lawyers often work together to assist our banking and other clients. Here, Joseph P. Harrington and Milton R. Gleit represented one of our banking clients in restructuring a defaulted corporate loan. As part of their work, Joe and Milt negotiated and documented the bifurcation and restructure of a series of defaulted term loans. The creative outcome was that fifty percent of the total debt was consolidated into a single new term loan; and the remaining fifty percent was converted into a preferred equity position in the restructured borrower.

Negotiation & Documentation of Work-Out/Restructure of Defaulted Mortgage Loan for Banking Client

In addition to closing commercial loan transactions for our banking clients, our Commercial Finance & Real Estate Transactions lawyers sometimes assist clients on the work-out and/or restructuring of a problem loan. On behalf of one of the firm’s banking clients, Joe Harrington successfully negotiated and documented the restructure of a defaulted loan secured by a first mortgage on an office building, thereby enabling the client to convert the defaulted loan into a performing asset.

Commercial foreclosure, then Negotiation & Documentation of Work-Out/Modification of a Defaulted Mortgage Loans for private lender

Joseph P. Harrington, Yvonne St. John

Commercial Finance – Successful Work-Out/Modification of Defaulted Mortgage Loans

In addition to closing commercial loan transactions for its banking clients, the firm from time to time assists those clients and private lenders with commercial foreclosures, which sometimes leads to the work-out and/or modification of a problem loan. On behalf of one of the private lending clients, Michelle L. Santoro, with the assistance of Joseph P. Harrington, successfully obtained a final judgment of foreclosure and sale; however, on the eve of the scheduled sale, negotiated and documented a settlement and modification of the defaulted loans, to be secured by a first mortgage on a community center, thereby enabling the client to convert the defaulted loans into a performing asset.

Representation of Banking Client, as Lender & Administrative Agent, in $90 Million Multi-Bank Secured Financing

Commercial Finance – Syndicated Secured Lending Transaction

| Presenter | Description | Organization | Date |

|---|---|---|---|

| Joseph P. Harrington | “The Fundamentals of Financing Real Estate Transactions” |

Pace University School of Law, White Plains, New York |

03/04/2010 |

| Joseph P. Harrington | Commercial Finance and Real Estate Development |

Real Estate Law Institute of the Land Use Law Center at Pace University School of Law, White Plains, New York |

05/17/2007 |

| Joseph P. Harrington | Commercial Lending Issues, as part of a program on “Commercial Real Estate Transactions” |

Pace University School of Law, White Plains, New York |

04/20/2005 |

| Joseph P. Harrington | Commercial Lending Isues,as part of a program on “Commercial Real Estate Transactions” |

Pace University School of Law, White Plains, New York |

04/21/2004 |

| Joseph P. Harrington | Commercial Real Estate Transactions |

Pace University College of Law, White Plains, New York |

01/17/2001 |

- A former member of the title advisory board of First American Title Insurance Company of New York, Joe has lectured on commercial mortgage transactions. He is a former director and officer of the Westchester County Bar Institute, has served as president of the White Plains Bar Association and as a co-chair of the Law Office Management Committee of the Westchester County Bar Association.

- A past director of the Westchester Philharmonic, Joe has served both as a trustee and counsel for the 52 Association for the Handicapped, Inc., a not for profit organization dedicated to aiding the physically challenged, which honored him in 1994 with its Medal of Honor. In 1993, he was honored by the National Conference of Christians and Jews (now known as National Conference for Community and Justice). In 1999, he and his deceased wife, Katherine, were honored by the Dominican Sisters Family Health Care Services (now known as Archcare at Home).

.