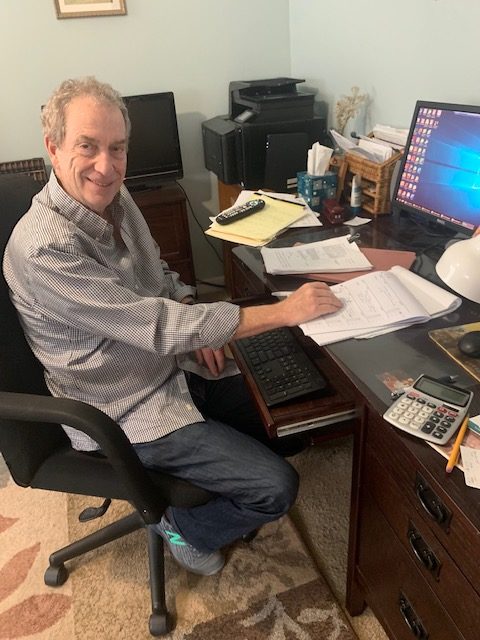

Howell Bramson

Counsel

Howell Bramson, a respected tax and estate planning lawyer in Westcheser, chairs our Corporate & General Business and Taxation groups. Howell works in a number of our practice groups. On the estate planning side, he has been involved in planning complicated estates, with an emphasis on estates involving business and real estate interests, as well as estate planning for non-resident aliens who invest in the United States. On the corporate side, he represents individuals and entities in various matters, including buying and selling companies, shareholder and operating agreements, employment agreements, private placements, and organizing a new company. On the tax side, he gives tax advice on mergers and acquisitions, S corporations, partnership transactions, and real estate transactions, including like-kind exchanges. Howell also has experience in the area of international taxation, especially in connection with non-resident aliens investing and doing business in the United States. Howell is also a lecturer before professional groups on the subject of tax planning and related issues.

Howell has received a peer review rating of AV®Preeminent on Martindale-Hubbell®. Howell has also been recognized as a New York Super Lawyer in the fields of Estate Planning/Tax and Corporate Business. Howell is also listed in Best Lawyers in America.

Areas of Experience

- Tax Planning for Individual and Corporations

- Will and Trust Drafting

- Estate Planning, to Avoid or Minimize Taxes

- Organizing a New Company

- Corporate Transactions

- Charitable Planned Giving

- International Taxation

- IRS Audits

Boggio, Bramson & Kutzin Named in List of Westchester’s Top Lawyers

McCarthy Fingar is pleased to announce that Westchester Magazine has named Gail M. Boggio, Howell Bramson and Michael S. Kutzin to its list of Top Lawyers in Westchester. Each year Westchester Magazine publishes its list of Westchester’s Leading Lawyers, excerpted from BL Rankings LLC list of Best Lawyers in America, the preeminent referral guide to the legal profession in the United States.

Rosh and Bramson Win Appeal on Appointment of Successor Trustee

McCarthy Fingar’s Surrogate’s Court Litigation lawyers represent clients in all phases of litigation on trusts and estates matters, including proceedings seeking the appointment or replacement of trustees of living or testamentary trusts. In Matter of Burrows, Robert H. Rosh and Howell Bramson, representing the preliminary executors of the decedent’s estate, won on summary judgment a proceeding in which their clients sought the appointment of a successor co-trustee of a multi-million dollar, living (grantor) trust (the “Trust”). On appeal, the Appellate Division, Fourth Judicial Department, unanimously affirmed the Surrogate’s Court decision and order granting our clients’ summary judgment motion. On their summary judgment motion, Rosh and Bramson established that the trust instrument required that the Trust be administered by two (2) trustees, but that, through deposition testimony and documentary evidence, the sole surviving co-trustee of the Trust was unfit to administer the Trust without the assistance of a co-trustee. In finding that the surviving co-trustee was unfit, the Surrogate’s Court found that the surviving co-trustee had failed to comply with various terms of the trust instrument, and had improperly delegated his fiduciary duties thereunder to another individual for years after the resignation of the original co-trustee of the Trust. The Surrogate’s Court consequently concluded that “[g]iven [the surviving co-trustee’s] less than adequate interest/ability to solely administer the Trust[,] together with the nature and language of the Trust, . . . two trustees (co-trustees) [were] necessary.” In granting our motion, the Surrogate’s Court further pointed out, and found, that the surviving co-trustee’s counsel’s argument that the proceeding was barred under the doctrine of res judicata, was without merit.Rosh Wins Summary Judgment on Contest of Will and Revocable Trust

McCarthy Fingar’s Surrogate’s Court Litigation lawyers represent clients in Will and Trust Contests. In Matter of Burrows (Surr. Ct., Herkimer County 2020), Robert H. Rosh and Howell Bramson, representing the decedent’s surviving spouse and the decedent’s financial advisor, won a summary judgment motion, upholding the decedent’s Will and his separate Revocable Trust Agreement. Here, Robert demonstrated, through voluminous documentary and testimonial evidence, that the decedent was cognitively alert, oriented, and otherwise fit and able to execute the disputed instruments, and that the instruments were not the product of undue influence or duress.

Boggio & Bramson Named in List of Westchester’s Top Lawyers

McCarthy Fingar is pleased to announce that 914INC. has named Gail M. Boggio and Howell Bramson to their list of 91 Top Lawyers in Westchester. Each year 914INC. publishes their list of Westchester’s Leading Lawyers, excerpted from BL Rankings LLC list of Best Lawyers in America, the preeminent referral guide to the legal profession in the United States. Gail was named in the area of Trusts and Estates Litigation, and Howell was named in the area of Tax Law.

McCarthy Fingar’s “Super Lawyers”

Nine of our lawyers have been selected Super Lawyers in the New York Metropolitan area. Dina M. Aversano has been selected in the areas of Estate & Trust Litigation, Commercial Litigation and Appellate. Gail M. Boggio has again been selected in the fields of Estate & Trust Litigation/Estate Planning & Probate/Elder Law. Howell Bramson has again been selected in the fields of Estate Planning/Tax and Corporate Business. Joseph Brophy has again been selected in the fields of Personal Injury/Medical Malpractice, General, Estate & Trust Litigation. Kathleen Donelli has again been selected in the fields of Family Law/Collaborative Law/Appellate. Dolores Gebhardt has again been selected in the fields of Family Law/Collaborative Law/Appellate. James K. Landau has again been selected in the fields of Commercial Litigation and Appellate. Frank W. Streng has again been selected in the fields of Estate & Trust Litigation and Estate Planning & Probate. Douglas S. Trokie has again been selected in the fields of Business/Corporate, Closely Held Business, Real Estate, Business and Civil Litigation. Super Lawyers is a listing of outstanding lawyers from more than 70 practice areas who have been recognized by their colleagues as having the highest degree of peer recognition and professional achievement.

“Super Lawyers” at McCarthy Fingar

Eight of our lawyers have been selected Super Lawyers in the New York Metropolitan area. Dina M. Aversano has again been selected in the areas of Estate & Trust Litigation, Commercial Litigation and Appellate. Gail M. Boggio has again been selected in the fields of Estate & Trust Litigation/Estate Planning & Probate/Elder Law. Howell Bramson has again been selected in the fields of Estate Planning/Tax and Corporate Business. Joseph Brophy has again been selected in the fields of Personal Injury/Medical Malpractice, General, Estate & Trust Litigation. Kathleen Donelli has again been selected in the fields of Family Law/Collaborative Law/Appellate. Dolores Gebhardt has again been selected in the fields of Family Law/Collaborative Law/Appellate. Frank W. Streng has again been selected in the fields of Estate & Trust Litigation and Estate Planning & Probate. Douglas S. Trokie has again been selected in the fields of Business/Corporate, Closely Held Business, Real Estate, Business and Civil Litigation. Super Lawyers is a listing of outstanding lawyers from more than 70 practice areas who have been recognized by their colleagues as having the highest degree of peer recognition and professional achievement.

Aversano, Boggio, Bramson, Brophy, Demouchet, Donelli, Gebhardt, Streng & Trokie Selected as Super Lawyers

Nine of our lawyers have been selected Super Lawyers in the New York Metropolitan area. Gail M. Boggio has again been selected in the fields of Estate & Trust Litigation/Estate Planning & Probate/Elder Law. Howell Bramson has again been selected in the fields of Estate Planning/Tax and Corporate Business. Joseph Brophy has again been selected in the fields of Personal Injury/Medical Malpractice, General, Estate & Trust Litigation. Kathleen Donelli has again been selected in the fields of Family Law/Collaborative Law/Appellate. Dolores Gebhardt has again been selected in the fields of Family Law/Collaborative Law/Appellate. Frank W. Streng has again been selected in the fields of Estate & Trust Litigation and Estate Planning & Probate. Douglas S. Trokie has been selected in the fields of Business/Corporate, Closely Held Business, Real Estate, Business and Civil Litigation. Preston C. Demouchet and Dina M. Aversano have been selected as Rising Stars: Preston, in the areas of Estate Planning & Probate; and Dina, in the areas of Estate & Trust Litigation, Commercial Litigation and Appellate. Super Lawyers is a listing of outstanding lawyers from more than 70 practice areas who have been recognized by their colleagues as having the highest degree of peer recognition and professional achievement.

Boggio, Bramson, Brophy, Donelli, Gebhardt, Miller & Streng Selected as Super Lawyers

Seven of our lawyers have been selected Super Lawyers in the New York Metropolitan area. Gail M. Boggio has again been selected in the fields of Estate & Trust Litigation/Estate Planning & Probate/Elder Law. Howell Bramson has again been selected in the fields of Estate Planning/Tax and Corporate Business. Joseph Brophy has again been selected in the fields of Personal Injury/Medical Malpractice, General, Estate & Trust Litigation. Kathleen Donelli has again been selected in the fields of Family Law/Collaborative Law/Appellate. Dolores Gebhardt has again been selected in the fields of Family Law/Collaborative Law/Appellate. Judge Sondra Miller has again been selected in the fields of Appellate/Family Law. Frank W. Streng has been selected in the fields of Estate & Trust Litigation and Estate Planning & Probate. Super Lawyers is a listing of outstanding lawyers from more than 70 practice areas who have been recognized by their colleagues as having the highest degree of peer recognition and professional achievement.

Bramson Co-Authors Article on Changes in New York Tax Law

Howell Bramson, who chairs our Taxation practice group, authored an article for the Newsletter for the Trusts and Estates Law Section of the New York State Bar Association, entitled “New York has at Last Updated its Estate, Gift & Trust Income Taxes – But Were These the Requested Changes.”

Streng Moderates & Bramson Speaks at Webcast on Changes in NYS Tax Law

Frank W. Streng and Howell Bramson participated in a webcast sponsored by the Trusts and Estates Law Section of the New York State Bar Association that discussed the changes that were just enacted in New York’s tax law. Effective April 1, 2014, New York made significant changes to its estate tax and in the income taxation of certain trusts. Howell spoke at the webcast. Frank was the moderator.

Bramson Speaks on Estate Valuation Discounting

Howell Bramson, who chairs our Taxation practice group, lectured in Elmsford, New York on November 13, 2013 for the Elder Law & Special Needs Section of the New York State Bar Association as part of an all-day program entitled, “Advanced Document Drafting for the Elder Law Attorney.” Howell provides an Overview of Estate Valuation Discount Vehicles, such as FLPs, CRTs, etc.

Boggio, Bramson, Brophy, Donelli, Gebhardt & Miller Selected as Super Lawyers

Six of our lawyers have been selected Super Lawyers in the New York Metropolitan area. Gail M. Boggio has been selected in the fields of Estate & Trust Litigation/Estate Planning & Probate/Elder Law. Howell Bramson has again been selected in the fields of Estate Planning/Tax and Corporate Business. Joseph Brophy has again been selected in the fields of Personal Injury/Medical Malpractice, General, Estate & Trust Litigation. Kathleen Donelli has again been selected in the fields of Family Law/Collaborative Law/Appellate. Dolores Gebhardt has again been selected in the fields of Family Law/Collaborative Law/Appellate. Judge Sondra Miller has again been selected in the fields of Appellate/Family Law. Super Lawyers is a listing of outstanding lawyers from more than 70 practice areas who have been recognized by their colleagues as having the highest degree of peer recognition and professional achievement.

Bramson Elected Co-Chair of WCBA Tax Section

Howell Bramson, who chairs our Taxation practice group, was elected co-chair of the Tax Section of the Westchester County Bar Association.

Bramson Speaks on Tax Planning for Non-Citizens

Howell Bramson, who chairs our Taxation practice group, lectured on “US Income Tax and Estate Planning for Non-Citizens” on May 23, 2013 in Tarrytown, New York for UJA Federation of NY’s 23rd Annual Westchester Estate, Tax and Financial Planning Conference. Click at Outline to see seminar outline.

Bramson, Brophy, Donelli, Gebhardt & Miller Selected as Super Lawyers

Five of our lawyers have been selected Super Lawyers in the New York Metropolitan area. Howell Bramson has been selected in the fields of Estate Planning/Tax and Corporate Business. Joseph Brophy has again been selected in the fields of Personal Injury/Medical Malpractice, General, Estate & Trust Litigation. Kathleen Donelli has again been selected in the fields of Family Law/Collaborative Law/Appellate. Dolores Gebhardt has been selected in the fields of Family Law/Collaborative Law/Appellate. Judge Sondra Miller has been selected in the fields of Appellate/Family Law. Joe Brophy has also been selected as one of Westchester’s top 25 lawyers. Super Lawyers is a listing of outstanding lawyers from more than 70 practice areas who have been recognized by their colleagues as having the highest degree of peer recognition and professional achievement.

Kiggins & Bramson Author Chapter on US Taxes on International Tax Systems

Robert J. Kiggins and Howell Bramson, both members of our Corporate and Taxation groups, have authored the United States chapter to a book edited by Roy Saunders, of International Fiscal Services, based in London, entitled “International Tax Systems and Planning Techniques”. The book covers the tax laws of over 30 countries, including most of the European Union, portions of Asia and Eastern Europe, the United States, Brazil and Canada, and a number of offshore tax havens. The purpose of the book is to assist in the tax analysis of cross border transactions and investments.

Bramson Lectures for UJA on Valuations & Discounts in Estate Planning

Howell Bramson lectured on “Taxes and Valuation Issues; Special Valuation Rules under Chapter 14” on May 19, 2011 in Tarrytown, New York for UJA Federation of NY’s 21st Annual Westchester Estate, Tax and Financial Planning Conference. See Seminar Outline.

Bramson Lectures on Estate & Tax Issues for Westchester Private Public Partnership for Aging Services

Howell Bramson lectured on October 14, 2010 in White Plains, New York on “Estate and Tax Issues” for the Westchester Private Public Partnership for Aging Services.

Bramson Lectures on Family Partnerships for UJA

Howell Bramson lectured on May 27, 2010 in Tarrytown, New York on “Update on Family Partnerships” for UJA Federation of NY’s 20th Annual Westchester Estate, Tax and Financial Planning Conference. For lecture materials, click on Seminar Outline.

Bramson Lectures on Family Wealth Transfer Issues for NYSBA

Howell Bramson presented on “Selected Aspects of Family Wealth Transfer” as part of of an all-day program in Mount Kisco, New York on October 23, 2007 entitled “Practical Skills: Introduction to Estate Planning” for the Trusts and Estates Law Section of the New York State Bar Association.

Bramson Lectures on Defective Grantor Trusts

Howell Bramson lectured on September 26, 2007 at Credit Suisse’s offices in Rye Brook, New York on “Cutting Edge Estate Planning Strategies- Utilizing FLPs, GRATs & Sales to Defective Grantor Trusts to Leverage Gifts.” For lecture materials, click on Seminar Outline.

Bramson Lectures for UJA on New Deferred Compensation Rules

Howell Bramson lectured on May 31, 2007 in White Plains, New York on “New Deferred Compensation Rules” for UJA Federation of NY’s 17th Annual Westchester Estate, Tax and Financial Planning Conference.

Bramson Lectures for UJA on Family Limited Partnerships & Limited Liability Companies

Howell Bramson lectured on May 25, 2006 in White Plains, New York for UJA Federation of NY’s 16th Annual Westchester Estate, Tax and Financial Planning Conference on “FLPs and LLCs – Current Status.”

Bramson and Donelli Lecture on Tax Issues Related to Divorce

Howell Bramson and Kathleen Donelli lectured on “Tax Issues Related to Divorce” on May 9, 2006 at The Bank of New York in White Plains. For lecture materials, click on Seminar Outline.

Bramson Lectures on Current Strategies Using Family Limited Partnerships

Howell Bramson lectured on May 26, 2005 in White Plains, New York for UJA Federation of NY’s 15th Annual Westchester Estate, Tax and Financial Planning Conference on “Current Strategies Using Family Limited Partnerships.” For lecture materials, click on Seminar Outline.

Bramson Lectures on Forming and Advising Businesses

Howell Bramson lectured in Tarrytown, New York on November 15, 2004 for the New York State Bar Association on “Forming and Advising Businesses”.

Bramson Lectures on Family Limited Partnerships & Current Strategies

Howell Bramson lectured on May 19, 2004 in White Plains, New York for UJA Federation of NY’s 14th Annual Westchester Estate, Tax and Financial Planning Conference on “IRS Attacks on Family Limited Partnerships and Current Strategies.” For lecture materials, click on Seminar Outline.

Bramson Lectures on IRS Attacks on Family Limited Partnerships and Current Strategies

Howell Bramson lectured in White Plains, New York on April 26, 2004 for the Westchester County Bar Association (Co-Sponsored by the Tax and Trusts and Estates Section) on “IRS Attacks on Family Limited Partnerships and Current Strategies.” For lecture materials, click on Seminar Outline.

Bramson Lectures for NYSBA on Forming and Operating the Partnership and LLP

Howell Bramson lectured in White Plains, New York on November 12, 2002 for the New York State Bar Association on “Forming and Operating the Partnership and LLP” as part of a program entitled “Practical Skills Forming and Advising Businesses”.

Bramson Lectures on Recent Developments on Family Limited Partnerships and Other Gifting Techniques

Howell Bramson lectured in White Plains, New York on September 25, 2002 for the Westchester County Bar Association (Tax Section) on “Recent Developments involving Family Limited Partnerships & Other Gifting Techniques”.

Bramson Lectures for UJA on Utilizing Non Qualified Deferred Compensation in Estate, Gift & Income Tax Planning

Howell Bramson lectured on May 23, 2002 for UJA Federation of NY‘s 12th Annual Westchester Estate, Tax & Financial Planning Conference on “Utilizing Non Qualified Deferred Compensation in Estate, Gift & Income Tax Planning.”

Bramson Lectures on Retirement Planning & Estate Planning for Physicians

Howell Bramson lectured on May 15 2002 at the Crowne Plaza in White Plains, New York as part of a program hosted by Merrill Lynch and the Firm on “Retirement Planning & Estate Planning for Physicians”.

Bramson Lectures on New Qualified Plan Minimum Distribution Rules

Howell Bramson lectured on September 24, 2001 for Westchester County Bar Association (Trusts & Estates and Tax Sections) on “New Qualified Plan Minimum Distribution Rules”.

Bramson Lectures on Taxation of Technology Companies

Howell Bramson lectured for Lorman Education on Taxation of Technology Companies.

New York has at Last Updated its Estate, Gift & Trust Income Taxes – But Were These the Requested Changes

by Howell Bramson, Susan Taxin Baer on 09/01/2014 Newsletter, Trusts and Estates Law Section of the New York State Bar Association [Read in full]International Tax Systems & Planning Techniques (United States Chapter)

by Howell Bramson on 01/01/2012Edited by Roy Saunders (International Fiscal Services)

[Read in full]Taxes & Valuation Issues; Special Valuation Rules under Chapter 14

by Howell Bramson on 05/19/2011UJA Federation of NY

[Read in full]Current Developments In Family Partnerships & Limited Liability Companies

by Howell Bramson on 05/27/2010UJA Federation of NY

[Read in full]Estate Planning Techniques Best Suited for the Current Economic Environment

by Howell Bramson on 05/21/2009UJA Federation of NY

[Read in full]Cutting Edge Estate Planning Strategies- Utilizing FLPs, GRATs & Sales to Defective Grantor Trusts to Leverage Gifts

by Howell Bramson on 09/26/2007Credit Suisse Securities (USA) LLC

[Read in full]Current Status of Estate Planning Using Family Limited Partnerships and Limited Liability Companies

by Howell Bramson on 05/26/2006UJA Federation of NY

[Read in full]Current Strategies Using Family Limited Partnerships

by Howell Bramson on 05/26/2005UJA Federation of NY

[Read in full]IRS Attacks on Family Limited Partnerships and Current Strategies

by Howell Bramson on 05/19/2004UJA Federation of NY

[Read in full]IRS Attacks on Family Limited Partnerships and Current Strategies

by Howell Bramson on 04/26/2004Westchester County Bar Association

[Read in full]Tax Law Changes Affecting Estate Planning

by Howell Bramson on 04/08/1998Legal Notes, Spring 1998

[Read in full]Waiver of Notification Rights

by Howell Bramson on 01/01/1996Legal Notes, Winter 1996

[Read in full]New Compliance Rules Concerning Charitable Contributions

by Howell Bramson on 03/03/1994Legal Notes, Spring, 1994

[Read in full]The Rebirth of Real Estate Investment Trusts

by Howell Bramson on 03/01/1994Legal Notes, Spring, 1994

[Read in full]New York Enacts Limited Liability Company Law

by Howell Bramson on 01/01/1994Legal Notes, Winter, 1994

[Read in full]Distributions from Individual Retirement Accounts

by Howell Bramson on 07/01/1993Legal Notes, Summer, 1993

[Read in full]New Legislation Affects Spouse’s Right of Election in New York State

by Howell Bramson on 10/01/1992Legal Notes, Fall 1992

[Read in full]Proposed Regulations Provide Operating Rules for Bankruptcy

by Howell Bramson on 04/20/1992Legal Notes, Spring, 1992

[Read in full]Estate Planning Strategies in Light of the Revenue Reconciliation Act of 1990

by Howell Bramson on 04/01/1992Legal Notes, Spring, 1992

[Read in full]Cancellation of Non-Recourse Debt: Tax Consequences

by Howell Bramson on 04/06/1991Legal Notes, Spring, 1991

[Read in full]Trusts as beneficiaries of IRAs (individual retirement accounts)

by Howell Bramson on 04/01/1991The CPA Journal, April, 1991

[Read in full]Tax Consequences of Cancellation of Nonrecourse Debt Remain Unsettled

by Howell Bramson on 08/01/1990The Journal of Taxation, August, 1990

[Read in full]Are Takeover Costs Deductible After National Starch?

by Howell Bramson on 12/06/1989The Journal of Taxation

[Read in full]Matter of Burrows, 192 A.D.3d 1485 (4th Dep’t 2021)

Howell Bramson, Robert H. Rosh

Appellate Practice – Surrogate’s Court Litigation – Trusts and Estates – Petition to Appoint Successor Trustee

McCarthy Fingar’s Surrogate’s Court Litigation lawyers represent clients in all phases of litigation on trusts and estates matters, including proceedings seeking the appointment or replacement of trustees of living or testamentary trusts. In Matter of Burrows, Robert H. Rosh and Howell Bramson, representing the preliminary executors of the decedent’s estate, won on summary judgment a proceeding in which their clients sought the appointment of a successor co-trustee of a multi-million dollar, living (grantor) trust (the “Trust”). On appeal, the Appellate Division, Fourth Judicial Department, unanimously affirmed the Surrogate’s Court decision and order granting our clients’ summary judgment motion.

On their summary judgment motion, Rosh and Bramson established that the trust instrument required that the Trust be administered by two (2) trustees, but that, through deposition testimony and documentary evidence, the sole surviving co-trustee of the Trust was unfit to administer the Trust without the assistance of a co-trustee. In finding that the surviving co-trustee was unfit, the Surrogate’s Court found that the surviving co-trustee had failed to comply with various terms of the trust instrument, and had improperly delegated his fiduciary duties thereunder to another individual for years after the resignation of the original co-trustee of the Trust. The Surrogate’s Court consequently concluded that “[g]iven [the surviving co-trustee’s] less than adequate interest/ability to solely administer the Trust[,] together with the nature and language of the Trust, . . . two trustees (co-trustees) [were] necessary.” In granting our motion, the Surrogate’s Court further pointed out, and found, that the surviving co-trustee’s counsel’s argument that the proceeding was barred under the doctrine of res judicata, was without merit.

Matter of Burrows, File No. 2014-171 (Surr. Ct., Herkimer County) (5-28-2020)

Robert H. Rosh, Howell Bramson

Surrogate’s Court Litigation – Trusts & Estates – Will and Trust Contests – Summary Judgment Motions

McCarthy Fingar’s Surrogate’s Court Litigation lawyers represent clients in Will and Trust Contests. In Matter of Burrows, Robert H. Rosh and Howell Bramson represented the decedent’s surviving spouse and the decedent’s financial advisor, as preliminary executors of the decedent’s estate and trustees of a revocable trust, in a will contest and a parallel proceeding that was brought by the decedent’s minor children from a prior marriage (through the children’s court appointed guardian ad litem and natural guardian), to set aside a revocable trust. The decedent’s children, through their guardians, argued that the decedent’s surviving spouse exerted undue influence upon decedent in connection with the making and execution of the decedent’s will and revocable trust, and that the decedent lacked the capacity to execute the disputed instruments. Through their guardians, the children moved for summary judgment, and Robert, on behalf of the proponents of the decedent’s will and trustees of the trust, cross-moved for summary judgment. On that cross-motion, Robert demonstrated, through voluminous documentary and testimonial evidence, that the decedent was cognitively alert, oriented, and otherwise fit and able to execute the disputed instruments, and that the instruments were not the product of undue influence or duress. The evidence included the following: deposition testimony of: (a) the decedent’s financial advisor; (b), the decedent’s personal chef; (c) the decedent’s lawyer; (d) the decedent’s accountant; and (e) the decedent’s heath care providers, including the decedent’s treating physician and nurse, Robert also showed that the decedent’s Will was consistent with the decedent’s testamentary plan (as shown by multiple prior wills that had been made by the decedent), and that the objectant-children had no basis to complain, having been made beneficiaries under a prior trust that had been established by the decedent, having a value of approximately $30,000,000. The decedent’s will was consequently admitted to probate, and the revocable trust was found to be valid and enforceable in all respects.

[Read in full]Representation of Foreign Investors in New York Theatrical Release

Corporate & General Business – Taxation – International Tax & Corporate Transaction

Client’s Use of IRS’s Offshore Voluntary Disclosure Initiative

Taxation – Internal Revenue Service – Offshore Voluntary Disclosure Initiative

Our Tax lawyers often advise clients on opportunities available through Internal Revenue Service-sponsored tax initiatives. The IRS has instituted a program – the Offshore Voluntary Disclosure Initiative – which may be of benefit to certain taxpayers who have offshore investments but have failed to disclose such investments and failed to report the income earned on such investments. Pursuant to US Treasury Regulations, disclosure of such investments is generally required on a “Report of Foreign Bank and Financial Accounts” or “FBAR” form, in which a taxpayer reports the existence of such assets. Here, Howell Bramson advised a client in connection with the client’s participation in IRS’s new program.

Corporate & General Business – Sale of Drug Store’s Prescription Inventory & Customer Lists to CVS

Corporate & General Business – Non-Compete Clauses – Sale of Drug Store’s Prescription Inventory & Customer Lists

Buying and selling businesses is an integral part of our Corporate & General Business practice. Howell Bramson has represented drug stores over the years, including a partial or complete sale of the business. Here, Howell represented the corporate owner of a substantial drug store in a sale of its prescription inventory and customer lists to CVS. As part of the transaction, the principal of the seller entered into a non-compete agreement.

Sale of Drug Store to Publicly Traded Chain of Drug Stores

Corporate & General Business – Sale of Drug Store to Publicly Traded Company

Our Corporate & General Business lawyers are involved in many different types of sales and purchases of businesses. Howell Bramson has been involved in the purchase and sale of drug stores over the years. Here, Howell completed the sale of a drug store to a publicly traded chain of drug stores.

Investment in Brazilian Fund

Corporate & General Business – Taxation – Investment in Brazilian Fund

Our Corporate and Tax lawyers often provide legal and tax advice clients on foreign investment opportunities. Howell Bramson advised a client in connection with a multi-million dollar investment, through an irrevocable family trust, in a Brazilian fund. With the growth rates in many emerging markets (e.g. the “BRIC” countries, i.e., Brazil, Russia, India and China) much higher than the growth rate in the United States, many investors are looking for opportunities in such countries. Such investments can involve complicated income tax issues as well as estate planning opportunities.

Representation of Owners of School Bus Transportation Business in Sale to Publicly-Traded Corporation

Corporate & General Business – School Bus Transportation Business

Our Corporate & Business lawyers often represent clients in the purchase and sale of businesses, and even develop expertise in the industry. Here, Howell Bramson represented the owners of a school bus transportation business in the sale of the business to a publicly traded corporation.

Representation of President & Major Interest Holder of a Limited Liability Company in Successful Negotiation and Sale of Business

Corporate & General Business – Sale of Business – Venture Capital Firm

Our corporate lawyers sometimes represent principals of companies that sell their company but continue on with the acquiring company. Here, Howell Bramson represented the president and major interest holder of a limited liability company that was sold to a venture capital firm for a purchase price in excess of $14 million. The client remained as President and interest holder after the sale.

Lefkowitz v. The Bank of New York as Preliminary Executor of Estate of Irene B. Marsh et al., 996 F.2d 600 (2d Cir. 1993)

Surrogate’s Court Litigation – Appellate Practice – Taxation – Spousal Consent – Challenge of Beneficiary Designation on Qualified Plan

Our lawyers often represent clients in dealing with beneficiary designations on pension and qualified plans. In one such case, Howell Bramson, Robert M. Redis and other lawyers at the firm successfully represented a surviving spouse’s estate and persuaded the lower court to invalidate a beneficiary designation on a qualified plan for the Decedent’s child (to the exclusion of the decedent’s spouse) on the grounds that the beneficiary designation violated the spousal consent rules under ERISA. The trial court’s determination was upheld, on appeal, by the Second Circuit Court of Appeals. The appeal also deal with significant legal questions, such as the applicability of ERISA to controlled foreign corporations and whether these sufficiently implicated the Interstate Commerce Clause of the United States Constitution.

[Read in full]| Presenter | Description | Organization | Date |

|---|---|---|---|

| Howell Bramson | Overview of Estate Valuation Discount Vehicles, such as FLPs, CRTs, etc. |

11/10/2013 | |

| Howell Bramson | US Income Tax & Estate Planning for Non-Citizens |

UJA Federation of NY, Tarrytown, NY |

05/23/2013 |

| Howell Bramson | Taxes And Valuation Issues; Special Valuation Rules Under Chapter 14 |

UJA Federation of NY’s 21st Annual Westchester Estate, Tax and Financial Planning Conference, Tarrytown, New York |

05/19/2011 |

| Howell Bramson | Estate and Tax Issues |

White Plains, New York, Westchester Private Public Partnership for Aging Services |

10/14/2010 |

| Howell Bramson | Update on Family Partnerships |

UJA Federation of NY’s 20th Annual Westchester Estate, Tax and Financial Planning Conference, Tarrytown, NY |

05/27/2010 |

| Howell Bramson | Estate Planning Techniques Best Suited for the Current Economic Environment |

UJA Federation of NY’s 19th Annual Westchester Estate, Tax and Financial Planning Conference, White Plains, NY |

05/21/2009 |

| Howell Bramson | “Selected Aspects of Family Wealth Transfer”, as part of an all-day program entitled “Practical Skills: Introduction to Estate Planning” |

Mount Kisco, New York, Trusts and Estates Law Section of the New York State Bar Association |

10/23/2007 |

| Howell Bramson | “Cutting Edge Estate Planning Strategies- Utilizing FLPs, GRATs & Sales to Defective Grantor Trusts to Leverage Gifts” |

Credit Suisse, Rye Brook, New York |

09/26/2007 |

| Howell Bramson | New Deferred Compensation Rules |

UJA Federation of NY’s 17th Annual Westchester Estate, Tax and Financial Planning Conference, White Plains, NY |

05/31/2007 |

| Howell Bramson | FLPs and LLCs – Current Status |

UJA Federation of NY’s 16th Annual Westchester Estate, Tax and Financial Planning Conference |

05/26/2006 |

| Howell Bramson | “Tax Issues Related to Divorce” |

The Bank of New York, White Plains, New York |

05/09/2006 |

| Howell Bramson | “Current Strategies Using Family Limited Partnerships” |

UJA Federation of NY’s 15th Annual Westchester Estate, Tax and Financial Planning Conference |

05/26/2005 |

| Howell Bramson | “Forming and Advising Businesses” |

11/15/2004 | |

| Howell Bramson | “IRS Attacks on Family Limited Partnerships and Current Strategies” |

UJA Federation of NY’s 14th Annual Westchester Estate, Tax and Financial Planning Conference |

05/19/2004 |

| Howell Bramson | IRS Attacks on Family Limited Partnerships and Current Strategies |

Westchester County Bar Association |

04/26/2004 |

| Howell Bramson | “Forming and Operating the Partnership and LLP” as part of a program entitled “Practical Skills-Forming and Advising Businesses” |

11/12/2002 | |

| Howell Bramson | “Recent Developments involving Family Limited Partnerships & Other Gifting Techniques” |

09/25/2002 | |

| Howell Bramson | “Utilizing Non-Qualified Deferred Compensation in Estate, Gift & Income Tax Planning” |

05/23/2002 | |

| Howell Bramson | Retirement Planning & Estate Planning for Physicians |

Merrill Lynch and McCarthy Fingar et al. |

05/15/2002 |

| Howell Bramson | New Qualified Plan Minimum Distribution Rules |

Westchester County Bar Association (Trusts & Estates and Tax Sections) |

09/24/2001 |

| Howell Bramson | Compensation Issues, Including Qualified And Non-Qualified Stock Options And Deferred Compensation |

UJA-Federation of NY’s Westchester Division |

05/24/2001 |

| Howell Bramson | Taxation of Technology Companies |

Lorman Education |

05/15/2001 |

- Member, Tax Section of New York State Bar Association

- Past Chair, Tax Section, Westchester County Bar Association

- Estate Planning Council of Westchester County (President, 2000; Vice President, 1999)

- Executive Committee, Benjamin Cardozo Society (2000-2005)